Hence, geographic diversification is a method to reduce risk by avoiding excessive market concentration. If that security experiences a failure, that is more or less a deadly blow to one’s portfolio. Nonetheless, in general, investors do not want to have all their assets based in one country for the same reasons as no one keeps their money in one stock. In multi-currency investments, that is a given. It means nothing more than holding securities from different regions. Stocks not factored in, other reasonable safe investments with high returns are certificates of deposit, treasury bonds, municipal bonds, corporate bonds, ETFs, and money-market accounts. Going by the opinion of most experts, this is a mundane approach to growing funds without taking sizeable risks.

Another rule that most investors used to look to follow is the 60/40 one, which states that 60% of the money should get put towards stocks, while 40% should go into bonds. Also called the 80/20 rule, it operates under the assumption that in life, 80% of results come from 20% of the effort put into an endeavor.Īsset allocation is the practice of putting capital into several categories of investment that are not correlated in their price action, assisting in mitigating risk. Then comes selecting the types of investments one needs to stack their portfolio with, and the Pareto Principle is something that everyone starting should know. Types of Investments You OwnĬommitting to a timeline and choosing the level of risk tolerance one is willing to accept in investing are the main two steps in putting one’s money to work, as everyone needs to give their funds time to grow and compound. What one must review when they have an investment aim set in mind gets elaborated below, the top three priorities that should also come into play in tracker selection. And pursuing tax minimization is making investments with favorable tax treatment to lessen the overall income take the government pockets. Liquidity refers to holding assets that can quickly get converted to cash. It is vital to note that secondary goals in the process usually exist, and when investing in securities is in question, two very established ones are liquidity and tax minimization. And to get steady income streams, most investors are ready to accept a bit more risk. Naturally, in investing, there is no such thing as a sure thing, as every trade comes with a specific amount of risk attached. Undoubtedly, the ways one can put their saved money to work continually increase, and each approach can get categorized according to three fundamental characteristics. A popular one is enjoying a stress-free retirement, and a competitor is accumulating impressive riches in a span of a few years.

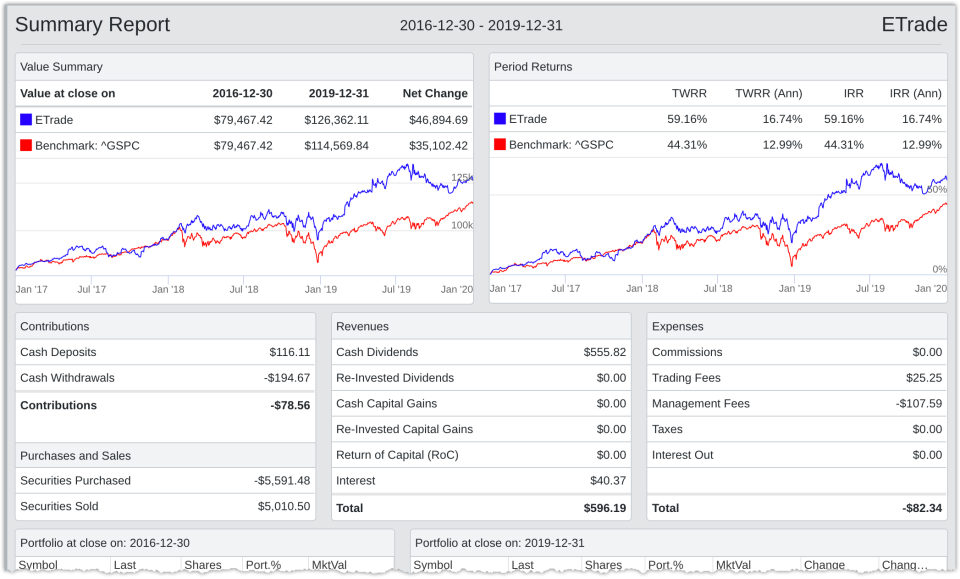

Below, we explain what goes into selecting an adequate one. It helps those deep into financial markets keep track of their funds in a currency familiar to them. That is why an absolute multi-currency portfolio tracker is a necessity. Without question, exchange rate fluctuations can make life hell for inexperienced traders and cause them to lose a handle on trades at every turn. But they eat up valuable time regarding traders having to manually convert currency, in addition to juggling multiple online accounts, creating and monitoring spreadsheets, and more. Standard portfolio trackers give investors a decent big picture regarding how their investments are doing.

0 kommentar(er)

0 kommentar(er)